Why Agents Need Embedded Insurance

Today’s rapidly evolving technology landscape and customer expectations are forcing the insurance industry to rethink its business models and processes to stay competitive in an ever-changing market.

In our previous article in this series, we explained the concept of embedded insurance, and the huge business opportunity it holds for insurers, by creating new revenue streams and lower distribution costs at the same time. In the following, we will look at how embedded, as a new distribution channel can be a game-changer for insurance agents to help them sell more products with less effort.

Increasing agent productivity and sales growth rate

Besides the potential for lower-cost distribution to a broader audience and reducing underwriting risks, the embedded insurance model can also contribute to increasing agent productivity.

Because of a tough race for insurance agents to reach their incentives, at the moment, most of their time is spent on hunting and prospecting new customers. According to a McKinsey survey from 2020, almost 30 percent of US insurance agents said their biggest challenge was lead generation, and 44 percent of them rated digital tools for agents and customers as the number one capability insurers can invest in to support them, and this rate probably only increased during the COVID-19 pandemic.

As embedded insurance solutions emerge and become available at the point of sale, they eliminate the necessity to hunt prospects. This will bring a shift in the future, where the majority of an agent’s time will be spent on advising and servicing, and only a small part remains direct prospecting. This shift could fundamentally change the role of an insurance agent from being notoriously reactive to proactively anticipate customer needs and provide personalized offers for end customers.

A trillion-dollar market opportunity for embedded insurance

McKinsey estimates that by 2025, sectors like B2B services, mobility, travel and hospitality, health, and housing will be reinventing themselves as new, digital ecosystems, adding up to a $60 trillion integrated network economy. Within these new ecosystems, the embedded insurance market could be worth $3 trillion in just a few years.

Despite this huge market opportunity, changing the operating model for insurance distribution will not happen from one day to another. Besides embracing new tools and assets across the value chain, it also requires a strong technical capability to build new, relevant products and implement new claims processes.

Digital ecosystems at the service of agents

“With the help of end-to-end digital platforms like Innoveo Skye®, agents can easily digitalize signatures, application and submission forms, and client onboarding processes to improve their teams’ productivity. Our wide range of functional capabilities and out-of-the-box API integrations have already been proven by our Tier 1 customers across the globe”, explains André Cohen, Director of Solutions Development at Innoveo.

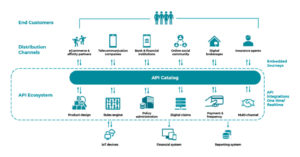

By abstracting insurance functionality into technology, incumbents can rapidly embed their innovative products in new marketplaces at an extremely low cost, and ultimately, help their agents to service their customers better.

In this sense, embedded insurance is already transforming the traditional insurance distribution model, enabling insurers and their agents to cross-sell their products and be present in relevant places where potential risks arise.